|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Filing for Bankruptcy in NJ: Understanding Your Options and Process

Filing for bankruptcy in New Jersey can be a daunting task, but understanding the process and your options can make it more manageable. This guide will provide insights into the types of bankruptcy available, the filing process, and what to expect.

Types of Bankruptcy in New Jersey

Chapter 7 Bankruptcy

Chapter 7, often referred to as 'liquidation bankruptcy,' involves selling off assets to pay creditors. It is designed for individuals with limited income who cannot pay back their debts. Chapter 7 bankruptcy calculator tools can help you assess eligibility.

Chapter 13 Bankruptcy

Chapter 13 is known as the 'wage earner's plan.' It allows individuals with a regular income to develop a plan to repay all or part of their debts over three to five years.

The Bankruptcy Filing Process

Preparing Your Petition

Before filing, gather all necessary documents, including a list of assets, debts, income, and expenses. This information will form the basis of your bankruptcy petition.

Submitting the Petition

File your completed petition with the New Jersey Bankruptcy Court. Once filed, an automatic stay is initiated, halting most collection activities.

The Trustee's Role

A court-appointed trustee will review your case, and in Chapter 7 cases, manage the sale of non-exempt assets to pay creditors.

Life After Bankruptcy

After your bankruptcy is discharged, it's crucial to rebuild your credit and maintain financial discipline. Consider financial counseling or budgeting workshops to help guide you.

For those considering relocating, chapter 7 bankruptcy denver offers insights on bankruptcy options in other states.

Frequently Asked Questions

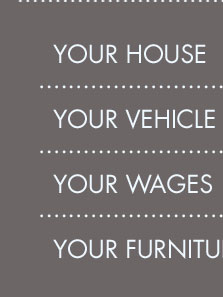

What assets can I keep in a Chapter 7 bankruptcy?

In New Jersey, you may keep certain exempt assets like your home, car, and personal belongings, up to specified limits.

How long does a Chapter 13 repayment plan last?

A Chapter 13 repayment plan typically lasts between three to five years, depending on your income and the amount of debt.

Will filing for bankruptcy stop all collection activities?

Filing for bankruptcy initiates an automatic stay, which temporarily stops most collection activities, including lawsuits, wage garnishments, and phone calls from creditors.

Can I file for bankruptcy without an attorney?

While it is possible to file for bankruptcy without an attorney, it is generally recommended to seek legal assistance to navigate the complex process and ensure all paperwork is completed accurately.

To file for bankruptcy in New Jersey, you must have resided in the state for at least 180 days prior to the filing date. There are two main ...

In order to get the bankruptcy discharge you must take an approved debtor education course either online or on the phone. The Certificate ...

Corporations and partnerships must have an attorney to file a bankruptcy case. Individuals, however, may represent themselves in bankruptcy court.

![]()